Trump’s economic destabilisationBy Tom O’Leary

Leading official forecasters do not expect the main industrialised countries’ growth to accelerate in the next period, and the UK economy is expected to be the weakest of all. This is despite the fact that the growth rate in the world economy since the recession has been extremely modest by historical standards. The Great Recession has been followed in the advanced industrialised economies by the Great Stagnation.

The World Bank’s latest economic outlook carries the title, ‘The turning of the tide?’ Its central conclusion is that, “global growth is expected to decelerate over the next two years as global slack dissipates, major central banks remove policy accommodation, and the recovery in commodity exporters matures.”

Similarly, the Organisation for Economic Co-operation and Development (OECD) has released its latest forecasts for its member countries, which include the advanced industrialised countries. They are largely aligned to the downbeat estimates of both the World Bank and the IMF.

None of these organisations has an impeccable forecasting record and mostly missed the onset of the Great Recession of 2008 almost entirely. But their errors are generally guided by over-optimism, and the belief in the self-correcting nature of economic imbalances. They are rarely wildly pessimistic. Table 1 below shows the latest OECD forecasts for selected countries or areas.

Capacity constraints

One of the most frequently cited causes of the anticipated slowdown is capacity constraints in the advanced industrialised economies, or as the World Bank puts it, the ‘dissipation of global [productive] slack’. This can take a number of forms. These include a shortage of capital (evidenced by rising bond yields in the US government bond market and elsewhere), a shortage of labour and/or skills (as unemployment rates fall especially in the US and UK, but workforce skills are not rising) or a shortage of available commodities (as shown by rising commodities’ prices).

However, each of these, financial capital, workforce skills and availability of commodities are components of the productive capacity of the economic. The increase or improvement of that productive capacity (‘the development of the productive forces’ in Marx’s terminology) is primarily a function of the level of investment. Availability of capital, workforce skills and access to commodities are important but subordinate factors, and can be increased through the returns on investment.

That investment can be in new fixed investment such as equipment, machinery, IT and so on, or investment in the education and training of the workforce, or in the extraction or creation of new sources of commodities, which in the modern era should increasingly be the development of renewable energy sources. Over-arching all of these is in the increase in the division of labour, or to use Marx’s term, the socialisation of production, which is the most powerful force of all.

It is the failure to invest, primarily a failure of business investment in the advanced industrialised economies which is the source of global capacity constraints. These then become manifest as rising interest rates, or labour and/or skills’ shortages or rising commodities’ prices.

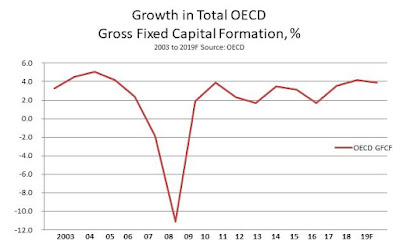

The growth rate of business investment is not accelerating, and in most of the international bodies’ forecasts it is set to slow once more. The trends in OECD business fixed investment (Gross Fixed Capital Formation, GFCF) are shown in Chart 1 below.

The OECD projection of 4.2% growth in GFCF for the OECD as a whole in 2018 would be fractionally the fastest growth on this measure since 2006, but is then forecast to slow once more to 3.9% in 2019. The implication is that this is as good as it gets.

It is important to note that the deceleration in the growth of GFCF preceded the Great Recession. And in the US the contraction in private residential investment began as far back as 2006. Falling investment preceded the decline in GDP as a whole and was the cause of that broader contraction.

Fixed investment is a key determinant of growth for the whole economy. Oddly, this is widely disputed. Yet it is self-evident that goods or services cannot be produced unless there is a prior capacity to produce them. Therefore, unless there is spare capacity (‘global slack’) output of goods and services can only be increased if there is first an increase in productive capacity through investment. Government spending, consumer demand and least of all ‘entrepreneurship’ can create new productive capacity.

The official forecasters’ concern rests on the analysis that spare capacity has been eroded or used up. This becomes decisive if there has also been very limited investment.

Residential investment does not increase the productive capacity of the economy. Housing provides a very important good, but not one which itself can produce other goods. At the same time, measuring Gross Investment does not take account of depreciation and depletion of fixed assets. Therefore, in relation to fixed investment, it is necessary to gauge the change in the Net Capital Stock. Taking these factors into account allows an assessment of the development of the key component of productive capacity.

In the OECD, the growth in the Net Capital Stock is miserably weak. Falling from an annual average growth rate of 3.7% at the turn of the century to hovering around just 1.5% now. This is consistent with the general stagnation of the advanced industrialised countries as a whole.

Signs of stress

The recent gyrations of financial markets, commodities’ markets and in the labour market in some countries should all be seen as indicators of this stress, rather than causes of slowdown.

To take one obvious example, the oil price has risen sharply over the course of the last 12 months before a sudden recent set-back. West-Texas Intermediate was trading at $43/bbl in June last year, and rose to $72/bbl in May this year before pulling back to under $66/bbl. But the oil price by itself has limited impact on world growth as a rise in price tends to redistribute incomes and growth to oil producers from net oil consumers. A fall in the price tends to do the opposite.

More fundamentally, the sharply rising price indicates that a moderate rise in demand associated with modest expansion of the world economy is not being met by rising supply of energy (which should of course come primarily from building renewable energy capacity). Rising prices indicate an inability to meet this demand at current prices (plus some activity by speculators). It remains to be seen whether the recent slippage in the oil price represents a fall in demand, or simply speculators getting out temporarily.

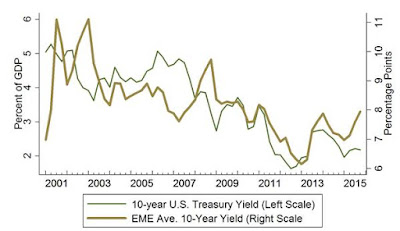

A similar pattern is evident in the US government bond market (or ‘Treasuries’). Yields on 10-year Treasuries rose in the last 12 months to over 3% but have since fallen back below that level. Treasuries yields matter to the world economy. Along with the level of the US Dollar they are the key global financial reserve instruments and a decisive source of the US’s dominance of global financial markets.

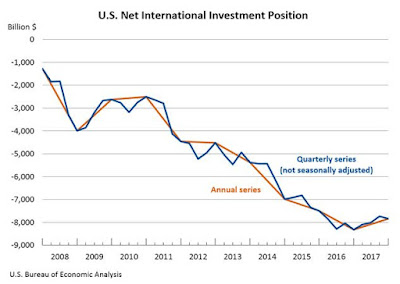

The yield on Government bonds also serves as an indicator of the global balance between available savings and investment. As the US is both the world’s dominant financial power and the world’s largest net debtor, any increase in US demand for capital will tend to push up bond yields more generally, not solely in the US. The US became the world’s largest net debtor in the mid-1980s. The deficit has risen steadily ever since and is now just under US$8 trillion, as shown in Chart 3 below.

The increase in demand for capital may be either for Consumption of for Investment. In this case, Trump has slashed business taxes and cut tax rates for the rich. This will increase in the US Federal deficit and will have the effect of pushing up bond yields to attract capital. Of course, if the recipients of Trump’s tax giveaways used those newly available funds to increase investment, or the US Government was itself was significantly increasing its own investment, then the US economy would grow more rapidly. The increase in returns on those investment would exceed the still modest level of Treasuries’ yields. But that is not the case.

In his latest blog Michael Roberts addresses many of these issues and highlights a concern about the shape of the US yield curve, focusing on the yield differential between 1-year and 10-year US Treasuries. Under ‘normal’ conditions the gap between these two should be fairly wide, as there are greater risks (including inflation risks) from lending long-term. Any sharp narrowing of the yield gap means that credit conditions are becoming restrictive and any move into a negative yield gap is usually associated with recession. Currently, this yield gap has been narrowing significantly.

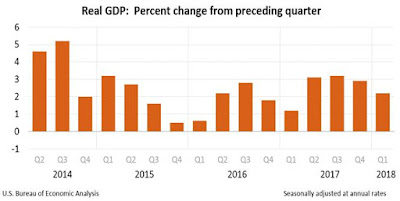

But there is little sign of a dramatic US slowdown, at least for the time being. US GFCF growth was 1.4% in the 1st quarter of this year, just 4.5% higher than a year ago, despite the first flush of the tax cuts. This does not yet suggest any significant acceleration in the pact of US investment, but neither does it represent a slowdown.

Corporate profits are decisive for business investment, so the recent slowdown in profits does not suggest a surge in business investment. Chart 4 shows the growth of US corporate profits since 2014.

At the same time, evidence from producers is that the modest expansion in the US is set to continue for now. That is certainly the message from the positive surveys of purchasing managers in the US. Overall, the US presents a mixed picture. There is no evidence of the much-touted boom. But overall conditions do not point to a marked decline at this point.

The danger of Trump

Instead, there is probably a greater danger to the world economy, and that is the policies of the Trump administration itself.

The global economy is already running into capacity constraints, as noted above. The US, in line with all the other major capital economies has not seen a recovery in investment that would lead to sustainably stronger growth. Conditions in the US economy and in the financial markets are not laying the basis for a boom, although this has been much forecast by mainstream economic commentators. Above all, US corporate profits do not point rapidly rising business investment.

Trump poses a threat to the world economy through increased protectionism, which will be discussed in a follow-up piece. But his domestic policies also pose a threat. In effect he is attempting to by-pass the problems of the US economy, including its low investment and savings rates by sucking in capital from the rest of the world.

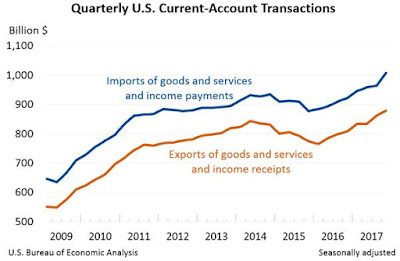

When Trump argues that the US is ‘the piggy bank the world is robbing’, he is stating the opposite of the facts. The US deficit on its Current Account was $466 billion in 2017, following a deficit of $452 billion in 2016. The deficit is a deficit in international trade in goods and services. Overwhelmingly this deficit is driven by the lack of competitiveness of the US economy (given its current levels of Consumption and the prevailing exchange rates), shown in Chart 5 below.

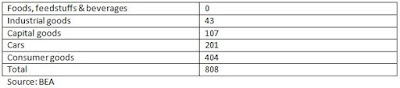

The source of deficit is clear by showing the categories of the deficit components, in Table 2 below. The Bureau of Economic Analysis data show that in 2017 exactly half of the total $808 billion US trade deficit was from consumer goods, and cars accounted for another quarter of the total.

All deficits on the current account must be off-set by a matching surplus on the capital account. In effect, the US borrows from overseas or runs down existing overseas assets in order to cover the deficit. The US is forced to continually borrow abroad to meet a lofty level of Consumption that cannot be met by domestic production.

If at the same time the demand for capital rises in the US, interest rates tend to rise to attract capital from overseas. This rising demand for capital can either be for Investment purposes or to finance further increases in Consumption.

Trump’s tax cuts are likely to lead to increased private Consumption. They will certainly lead to a much wider Federal Government deficit. It is the anticipation of this trend which has been mainly responsible for driving US bond yields higher.

But capital flows from the rest of the world can prove disastrous for ‘emerging market’ economies. The 1998 Asian financial crisis was caused by rising long-term US interests, as was the earlier Latin American debt crisis of the 1970s. Given the relative size of their economies, capital flows to fund rising US deficits can be vastly proportionately greater for those countries that the capital is flowing from. It used to be said of the other Western economies that ‘if the US sneezes, they catch a cold’. Now it could be said, for those countries with substantial savings and no controls on capital movements, that if the US sneezes, they can catch pneumonia. Chart 6 below reproduces a chart from the US Federal Reserve on the relationship between US 10-year yields and average yields in ‘emerging markets’.

But the Less Developed Countries are not uniform, and the effects of all changes are registered unevenly. There are already strains appearing in some of those countries, sometimes severe as in the case of Argentina and Turkey. They have both experienced sharp sell-offs in their currencies, and downward pressure on government bond markets. Argentina’s President Macri was a darling of the neoliberal economists’ consensus whose first act was to remove capital controls. Humiliatingly, he has now had to go to the IMF for another onerous bailout.

The IMF, which is dominated by the US, almost always insists on the removal of capital controls on countries seeking funds for a bailout. This directly serves US continuous needs for overseas capital. It is not coincidental.

Other countries are not immune from the current turmoil. There has been intense downward pressure on currencies and/or stock markets leading the central banks to make unwanted rises in interest rates. Brazil, Mexico, South Africa and India have all come under pressure. And with the US Federal Reserve Bank widely expected to raise official rates once more, the pressures may intensify.

The UK is not immune from any of these pressures, along with the other advanced industrialised economies. But it is a special case. As noted previously, it is forecast to be the weakest country within the advanced economies over the next period. It is a distinct case, owing to the particular negative effects of the Brexit vote. But this will be dealt with in a separate piece.

There are strains in the advanced industrialised economies as a whole, including the US. But far greater strains are evident in the Less Developed Countries. Their cause is the same, the effects of the Great Stagnation, driven by the extraordinarily low levels of investment in the advanced industrialised economies. This is primarily the weakness of business investment, combined with a general refusal of governments to fill the gap.

This structural weakness is being exacerbated by the reckless Trump policy of tax cuts for big business and the rich in the US, which is sucking capital from the rest of the world and destabilising it. Trump poses a new threat to global living standards.

Recent Comments