.947ZAusterity isn’t over. It will resume, but it has been suspended for one yearBy Tom O’Leary

The claim for the latest Tory Budget is that ‘austerity is coming to an end’, and has been dutifully echoed by the Tory press and the BBC.

In reality austerity policies will continue long into the future, extending the longest recorded fall in living standards in this country. The exception is the calendar year 2019, where both Government Consumption and Investment will rise as a one-off, before planned cuts in future years.

Government Outlays

The Table shows there is an increase on both Government Consumption and Government Investment in 2019. They are both much higher, relatively speaking than in the two preceding years 2017 and 2018. It is also important to note that the growth rate of both these sector of Government outlays fall away again in subsequent years. Both of these were also revised substantially higher solely for 2019, compared to the March 2018 Spending Review, whereas other years have almost all been revised lower compared to March.

The OBR Table also reveals a deep and abiding pessimism about economic prospects. By 2023 this business cycle will be very mature, as the last recession ended in mid-2009. Yet even without a renewed downturn real GDP growth is officially projected to average no more than 1.5% annually over the entire period. Chancellor Hammond explicitly states that the trend growth rate for the economy has been lowered by the financial crisis. On official forecasts, sluggish growth is the new normal.

The driving force of the economy is Investment, and with it the increasing participation in the division of labour through foreign trade. This is not the OBR’s framework, which remains stuck in a neoliberal/Treasury paradigm that Consumption drives growth. Even so, the OBR’s forecasts are noteworthy for expecting no increase in net trade, and the worst ever growth rate of fixed Investment over such a prolonged period.

Without better growth than is forecast, it is extremely difficult for living standards to rise.

Crucially, the OBR expects corporate profits to slow even further from 3.5% growth recorded in the first half of 2018. It projects that the slowdown will continue with just 2.8% profits’ growth in 2019 and only matching the average real GDP growth rate for the economy in further years.

It also notes that business Investment has risen by just 1.9% in the two years since the EU referendum and fell outright in the first half of this year. If the OBR is even close in its assumptions about profits, it is difficult to see where any rebound in business Investment will come from.

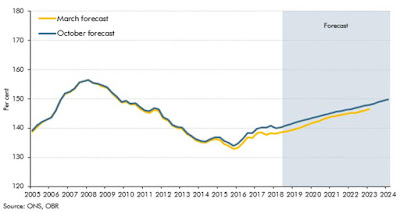

In fact, with weak growth from both business Investment and the Government, the OBR’s entire forecast even of very weak growth rest on a renewed increase in household indebtedness. The Chart below is Chart 3.23 taken from the OBR’s Economic and Fiscal Outlook to accompany the Budget.

Recent Comments