.866ZLabour’s economic alternative to the budget should centre on a National Investment Bank

By Michael Burke and John Ross

Introduction

Labour is now carrying out extremely effective campaigning against Tory policies – on tax credits, on the sweetheart Google taxation deal, in support of the junior doctors and pinning the responsibility for the crisis in the NHS squarely on the Tories. This excellent work needs to continue and be strengthened.

But in the forthcoming budget Labour must also set out the framework for a comprehensive macro-economic alternative to Osborne’s austerity. This article argues why the centre piece of this should be to reinforce the existing pledge to increase infrastructure investment with the establishment of a National Investment Bank.

Osborne left swimming naked as the economic tide goes out

In a famous phrase the American billionaire investor Warren Buffet said of the economy: “when the tide goes out… you discover who’s been swimming naked.” Chancellor George Osborne fits this phrase perfectly. As the world economy slows, with consequent turmoil on financial markets, it is demonstrated that the Chancellor’s claims of ‘economic success’ are entirely bluff.

What Osborne has done in the last six years is to go on an international borrowing binge which failed to correct the basic imbalances and weaknesses in the British economy and he has left it dangerously unprepared for and exposed to the current slowdown in the world economy. Osborne ensured that the average British citizen, and even more the poorest members of society and those who rely on the NHS, pay the price for his failure to confront the key issues in the British economy. His real policy was exemplified in the sweetheart deal for Google, the recreation of the ‘bonus culture’ in banks, in contrast to the attack on the NHS and his attempt to ram through cuts in tax credits. This is the real context for Osborne’s coming Budget.

Instead of the further attacks on living standards and profligate international borrowing the appropriate macro-economic policy framework for Labour would focus on two things.

· First, to address Britain’s chronic investment shortage – only by increasing investment can living standards sustainably rise.

· Second, to prepare contingency measures in the event that the current slowdown worsens.

In contrast to Osborne’s attack on living standards and profligate international borrowing, Labour’s policy of productive investment, led by the creation of a National Investment Bank (NIB), should begin to tackle the basic imbalances in the British economy. The NIB will finance the economic growth that will lead to both rising wages and rebuilding social services, and will prepare Britain for the new international choppy waters it is entering.

In short people will be ‘better off with Labour’.

Osborne’s reckless international borrowing

The key current trends in the global and British economic situation are clear.

The world economy is slowing and Britain is not excluded from this – puncturing Osborne’s claim of ‘economic success’. In line with these economic realities the World Bank has cut its growth forecasts for the leading economies and the Bank of England has cut its growth forecast for the British economy. The British economy has in fact been slowing for some time with 3% growth in mid-2014 declining to 1.9% at the end of last year.

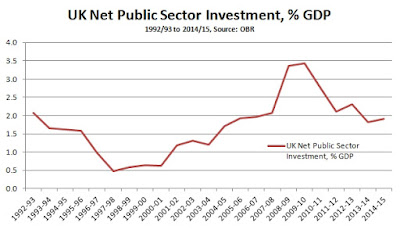

But Figure 1 shows the real basis of even the temporary upturn of British growth – Osborne’s rapidly growing international borrowing which leaves Britain exposed to the new worsening of the international economy.

When Osborne became Chancellor in May 2010, i.e. during the 2nd quarter of 2010, Britain’s rate of net overseas borrowing was an annualised £31.2 billion. By the 3rd quarter of 2015, the latest available data, it was an annualised £70.9 billion. As a percentage of GDP overseas borrowing almost doubled from 2.0% of GDP to 3.8%- as shown in Figure 1.

Figure 1

Under Osborne Britain, as shown in Figure 2, has borrowed an extraordinary £340 billion from abroad – equivalent to nearly one fifth of Britain’s current GDP. Far from being ‘prudent’ the Chancellor has simply financed his so called ‘recovery’ by the most unstable form of borrowing – from foreign creditors.

Figure 2

Failure of investment to recover

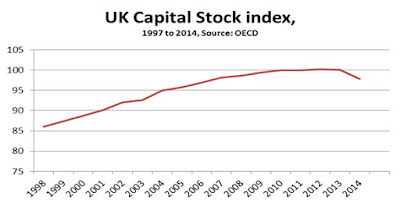

Yet despite Osborne’s extraordinary rate of foreign borrowing the Chancellor has failed to correct the most fundamental of all imbalances in the British economy, and the key source of its economic problems such as low growth and low productivity increases – its inadequate investment level.

Despite the inevitable severe initial fall in fixed investment under the impact of the international financial crisis, from 19.0% of GDP in 2007 to 15.6% of GDP when the Chancellor came to office, Osborne has ensured that any economic growth which did occur in the cyclical recovery overwhelmingly went into consumption not investing for the future. Between the 2nd quarter of 2010 when Osborne came to office and the latest data for the 3rd quarter of 2015 in current price terms three quarters of the recovery in output went into consumption and only a quarter into investment. This failure to invest has left Britain both unable to sustain any prolonged economic expansion and exposed to any international economic downturn.

The real Budget choice

The Chancellor claims that he must impose even greater austerity in the March Budget, due to Britain facing a “

dangerous cocktail of new threats”. The reality is that it is Osborne’s own policies, his failure to invest, his large scale international borrowing, which are a particularly dangerous liquor in that concoction.

The reality of this ‘dangerous cocktail’ is that the Chancellor is the barman. The British economy is slowing and unprepared for any international downturn because he recklessly promoted consumption, in particular soaring house prices, in order to get re-elected and it is that short-lived mini-boom financed by foreign borrowing which is inevitably fading.

The failure was inevitable because rising consumption without investment cannot be sustained. It simply leads to more debt or a rundown in savings. A sustainable growth in economic growth and consumption must be based on investment. This hard economic reality is the core of Labour’s alternative for a sustainable economic recovery.

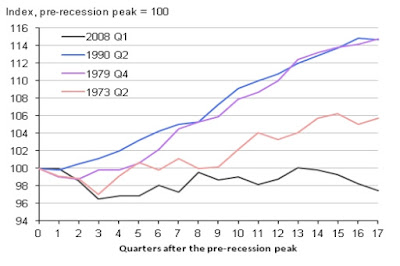

Such investment for sustainable economic recovery is precisely what is lacking under Osborne. Since the beginning of the crisis in the 1st quarter of 2008 in inflation adjusted terms consumption has risen by £89.3 billion. Over the same period Investment has risen by just £9.3 billion. It is no surprise therefore that in per capita terms GDP has barely risen at all, or that more people are working longer hours for the same real return on pay. It is almost unprecedented for productivity to stagnate during most of a recovery phase but this is what Osbornomics has achieved because investment has remained so weak.

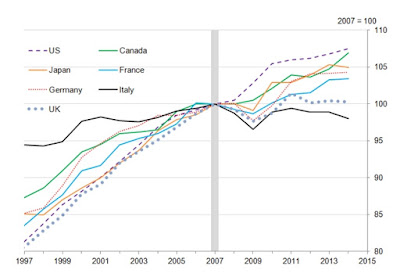

The Chancellor’s policy of austerity weakened the economy and sapped investment further. Under George Osborne the Government cut its own level of investment. The consequence of Osborne’s economic policies was that productivity actually declined from mid-2011 onwards and had only just recovered in time for the General Election. According to the Office of National Statistics (ONS), “UK productivity in 2014 was lower than that of France, Germany and the US by 32-33 percentage points, and lower than that of the rest of the G7 by 20 percentage points.” Both of these are record gaps in productivity with the rest of the G7. Higher living standards and improved productivity depend on higher investment which Osborne demonstratively failed to produce.

Furthermore, the Chancellor’s “fiscal charter” makes the situation worse. Osborne does not understand the difference between borrowing for investment and borrowing for consumption – something every business and every family understands. By lumping all forms of government borrowing together, and rejecting them all, he would ban a family not only from seeking to pay its electricity or food on credit card borrowing, which is a road to ruin, but also from borrowing to buy a house – a totally sensible objective.

If Osborne were a farmer his fiscal charter would rule he should not invest in a tractor – because it involved borrowing!

‘Extremists’ supporting infrastructure investment

Labour should restore sanity to public finances by clearly distinguishing productive capital expenditure, investment, from current expenditure – consumption. Labour should not borrow over the course of the business cycle for current expenditure. But it will borrow for productive investment – thereby laying the basis for economic growth and rising living standards.

In reality at present particularly favourable conditions exist to borrow for infrastructure spending at extremely historically favourable rates which will boost the productivity of the British economy– as writers such as Martin Wolf, chief economics commentator of the Financial Times and figures such as former US Treasury Secretary Lawrence Summers, have rightly emphasised. Indeed, the words Martin Wolf wrote in the Financial Times on 13 February 2014 require no alteration:

“Does the UK have a sensible strategy for recovery? Just recall: the last time it [the UK] tried the credit-expansion route to growth, it ended up in a huge financial crisis. Why should it rationally expect a different outcome this time?…

An expansion of private borrowing to buy ever more expensive houses is deemed good, but an expansion of government borrowing, to build roads or railways, is not. Privately created credit-backed money is thought sound, while government-created money is not. None of this makes much sense.”1

Or if the chief economics commentator of the Financial Times is a too ‘hard left’ extremist for the Chancellor perhaps he will listen to the words of his former US counterpart – US Treasury Secretary Lawrence Summers:

“The… approach… that holds most promise –means ending the disastrous trend towards ever less government spending and employment each year – and taking advantage of the current period of economic slack to renew and build up our infrastructure. If the government had invested more over the past five years, our debt burden relative to our incomes would be lower: allowing slackening in the economy has hurt its potential in the long run.”2

Labour’s policy of sustainable investment and a National Investment Bank

Labour’s approach is diametrically opposite to Osborne’s. It has repeatedly set out the case for increased public sector investment – which, through economic growth and the well-known ‘multiplier effect,’ will stimulate and not reduce private investment. Labour has correctly stated it will run a balanced budget on current spending over the business cycle. This means the Government borrowing over the course of the business cycle will be exclusively directed towards investment. The Chancellor’s false fiscal charter failure to distinguish current expenditure and investment will be scrapped. The government will borrow for investment – including by creating a National Investment Bank. But current spending on public services would be met from taxation revenues.

This is correct because it is sustainable. Borrowing for investment in some cases, for example on transport or housing, leads directly to revenue. But above all it leads to economic growth and therefore rising tax revenues. As a result, the Government can finance its borrowing from those rising tax revenues. By contrast, persistently borrowing to fund current or day-to-day spending (frequently, and inaccurately described as ‘Keynesianism’) is unsustainable.

Labour’s approach is to increase investment. This will lead to stronger and more sustainable economic growth. The effect on government revenues is twofold. Tax revenues will rise with increased economic activity. At the same time Government outlays will fall as more people are in work and more of those workers are in higher-skilled, higher paid jobs. As a result, the current budget will actually move towards balance.

This is in contrast to austerity, which is the economic equivalent of applying leeches to a very sick patient. This is the reason the Chancellor will again miss his deficit targets in the current Financial Year, the reason why the deficit rose in 2012 as austerity took hold and the reason why the Chancellor is nowhere near eliminating the deficit as he had boasted in 2010. Austerity attempts to shift government debt and deficits onto the shoulders of ordinary people, and so weakens the economy that businesses reduce investment even further.

National Investment Bank

The centrepiece of Labour’s investment policy is the creation of a National Investment Bank. This will invest in key infrastructure projects, renewable energy, transport, affordable rented housing and education. This would be founded by public sector capital and borrow in the financial markets with the implicit guarantee of the UK Treasury.

As a result it will be able to borrow at close to the extraordinarily low interest rate levels currently available to the Government itself. These interest rate levels represent the financial market appetite to lend to Government. Currently, UK Government bond (gilts) yields are less than 1% for 5 year and 1.5% for 10 years. It can even borrow for

46 years at a yield of MINUS 1% on index-linked (linked to inflation) gilts. This represents the desire of long-term investment vehicles such as pension and insurance funds to invest securely over very long maturities and the absence of instruments to invest in.

In these circumstances a refusal to borrow for investment is economically irresponsible and counterproductive. In addition to the beneficial productive effects for the economy there is a clear ‘signal’ from the market that it wants to lend to government. Once more to quote that key member of the ‘hard left’ Martin Wolf from the Financial Times on 17 May 2012:

“With real interest rates close to zero… it is impossible to believe that the government cannot find investments to make itself, or investments it can make with the private sector, or private investments whose tail risks it can insure that do not earn more than the real cost of funds. If that were not true, the UK would be finished. Not only the economy, but the government itself is virtually certain to be better off if it undertook such investments and if it were to do its accounting in a rational way… This does not even deserve the label primitive. It is simply ridiculous.”3

The initial funding for the National Investment Bank, which will play a key role in Labour’s increase in investment, is straightforward. The Government should borrow the capital utilising the opportunity presented by current extremely low interest rates. In more unfavourable circumstances of severe economic downturn Labour would be prepared to use People’s Quantitative Easing, finance created by the Bank of England to finance productive investment as opposed to the bank bailouts it has hitherto been chiefly directed to, but such a policy is not necessary in present circumstances to finance the NIB. Approximately £50 billion should be raised over the course of a parliament to fund the NIB.

This is a substantial amount to fund the initial capital for an infrastructure investment bank. In Germany the equivalent bank is the KfW (originally Kreditanstalt für Wiederaufbau or Reconstruction Credit Institute). The KfW has €21.6 billion of equity capital and total capital (including debt) of €73.4 billion which supports €489 billion in assets (lending to projects). It would take time for the NIB to reach that position, but it shows what is possible.

Crucially, the NIB would be able to use this Government-funded capital to borrow on its own account in the financial markets. Under the arcane rules of Government finances it need not count on the Government’s balance sheet at all, either as borrowing or accumulated debt. As the KfW example shows, it is possible to borrow comfortably around six or seven times the original capital.

Economic Impact

One of the objections to public sector-led investment programmes is that there are no ‘shovel-ready’ projects to invest in – which would itself be a disgrace given Britain’s lack in investment and productivity compared to other countries already noted. But even this argument has collapsed now that the Government has established its own National Infrastructure Commission with a

National Infrastructure Plan. No doubt, Labour can set some of its best brains to revising and re-prioritising the Plan in relation to its own economic priorities. But the Plan and the projects are already there. The problem is the Government, because of its essentially exclusive reliance on the private sector, is simply not delivering them on the scale and pace required.

The work of building up the necessary projects for investment, including by the National Investment Bank, could begin immediately and would be well towards the final goal over the lifetime of the parliament. In the first year the NIB could be established and funded, and borrowing begun and projects prioritised for work to begin or increase in the second year. By the end of the current Parliament work could have been under way for a full three years.

In reality, this Government has no intention of following that route. Although it established a minuscule ‘Green investment Bank’ this was a political sop and is being wound up. But Labour could begin the detailed preparatory work now and hit the ground running in 2020. A full four years of productive investment is possible.

In four years a capital programme funded by £50 billion in capital and amounting to £300 billion in total could be well under way. The general economic impact is possible to gauge using the UK Treasury’s own economic modelling. Investment in infrastructure has the effect of raising growth in the short-term and by increasing growth over the long-term through improved productivity. The precise impact varies by sector and by project, but in a range of raising growth by between 1.5 and 1.9 times the initial investment. On average we can say that a £300 billion investment programme will raise GDP by around £500 billion (an approximate average of 1.7 times).

In general,

according to UK Treasury models (pdf), every £1 increase in economic output is reflected as a 75 pence improvement in government finances. 50 pence of this arises from increased taxation revenues and 25 pence from lower outlays as poverty reduces and employment grows. Therefore, over time three-quarters of the additional growth produced by the NIB’s investment programme will return to Government in the form of higher tax revenues and lower outlays. This is an improvement of £375 billion (out of £500 billion in increased output) in total government finances over a period of years. Just as the private sector invests for growth and a financial return, so too should the public sector. The difference is that the public sector also enjoys a further financial benefit not available to the private sector; increased taxation revenues and lower social spending outlays.

From these funds, it is possible to increase investment further and to fund the improvement, not the deterioration in public finances. It is possible to upgrade the NHS and improve it, to address the schools shortage and return to free higher education. Social protection can be improved and a decent level of income in retirement provided for all.

The forthcoming Budget will threaten to undermine further the living standards of the overwhelming majority of the population. But it will therefore be an opportunity for Labour to set out a very clear alternative that will begin to reverse that process and raise their living standards. Naturally Labour will have to deal with reversing numerous anti-social policies in the budget but the macro-economic centre piece of its alternative should be the pledge to raise investment, a clear distinction between current and capital expenditure in the budget, and the establishment of a National Investment Bank.

References

1. Wolf, M. (2014, February 13). Hair of the dog risks a bigger hangover for Britain. Retrieved February 20, 2014b, from Financial Times: http://www.ft.com/intl/cms/s/0/1cd67c18-93e6-11e3-a0e1-00144feab7de.html?siteedition=intl#axzz2silAZOQx

2. Summers, L. (2014, January 5). Washington must not settle for secular stagnation. Financial Times.

3.Wolf, M. (2012, May 17). Cameron is consigning the UK to stagnation. Financial Times.

John Rosshttps://www.blogger.com/profile/08908982031768337864noreply@blogger.com3

Recent Comments